Cfd trading is the subject of much discussion among traders and investors. Some consider it a risky activity, while others believe it is one of the most profitable ways to invest in the stock market. cfd trading is an abbreviation for Contract for Differences. In a nutshell, it allows traders to trade on the price movements of assets such as stocks and commodities, without actually owning those assets themselves. In this blog post, we will explore the world of Cfd trading, and see what makes it such an exciting way to make profits.

Cfd trading allows investors to leverage their trades, which means they get exposure to a larger percentage of the market for less upfront capital. The leverage can be as much as 100:1, which means that traders can trade with only 1% of the total value of the trade. This feature gives Cfd trading an edge over other types of trading, as traders can take advantage of the smallest movements in the market. However, leverage can also be a double-edged sword, as it can lead to significant losses if trades do not go as planned.

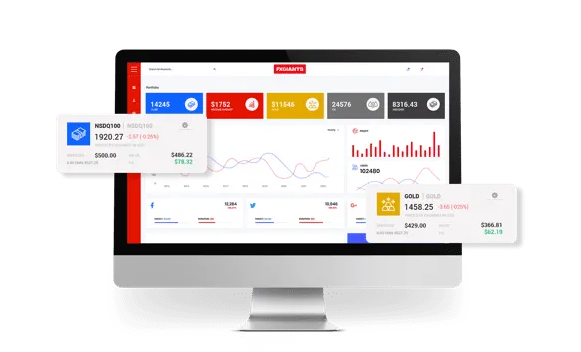

Cfd trading is flexible and accessible, as it is available 24/7. This feature makes it popular among traders who are looking to make quick profits. The ability to trade on markets that are open during different time zones also gives traders the opportunity to trade the world markets from anywhere in the world. Another benefit of Cfd trading is that traders can short-sell assets, which means they can profit from falling prices. This feature is not available in other types of trading, and it makes Cfd trading a unique and potentially profitable option for traders.

Cfd trading requires a good understanding of market trends and risk management. Traders should conduct thorough research and analysis of the markets they are trading in before investing. It is important to have a clear strategy on when to enter and exit trades, as well as risk management techniques to mitigate losses. Traders should also keep up-to-date with the latest news and events that may affect the markets they are trading in. Cfd trading also involves paying attention to Volatility Indexes, as high volatility implies larger returns or losses depending on market direction. Using a reputable broker who offers a range of trading tools and support can also be extremely helpful for novice traders.

short:

In short, Cfd trading is a highly dynamic, flexible, and potentially profitable way to invest in the stock market. It is accessible to anyone with an internet connection and basic knowledge of market analysis. Cfd trading offers traders leverage, flexibility, and the potential to make quick profits. However, it requires discipline, risk management, and careful analysis of market trends to ensure success. Traders who are willing to put in the time and effort to master this form of trading can reap the rewards of a potentially lucrative investment strategy.